The Benefits of Virtual CFO Services: How a vCFO Can Transform Your Business Financially

Benefits & Role of Virtual CFO: How VCFO Services Elevate Financial Strategyg

In today’s world, businesses are always looking for ways to manage their money better and grow. One smart solution that many companies are using is the Virtual CFO (vCFO) service. This article will explain what a virtual CFO is, what they do, and how their services can help businesses improve their financial strategies.

What is a Virtual CFO?

A Virtual CFO is a financial expert who helps businesses manage their money, but they do it remotely. This means they don’t have to be in the office every day. Instead, they use technology to provide their services from anywhere. This is great for small and medium-sized businesses that may not have enough money to hire a full-time Chief Financial Officer (CFO).

The role of a virtual CFO includes many important tasks. They help with financial planning, budgeting, forecasting, and managing risks. By using a virtual CFO, businesses can focus on what they do best while leaving the financial details to the experts.

What’s Included in Virtual CFO Services?

Virtual CFO services offer a wide range of financial management tasks. Here are some of the main services they provide:

- Financial Planning and Analysis: A vCFO helps businesses create financial plans and analyze their financial situation to make better decisions.

- Budgeting and Forecasting: They assist in making budgets and forecasts that help businesses understand how to spend their money wisely.

- Cash Flow Management: Managing cash flow is crucial for any business. A virtual CFO keeps track of money coming in and going out to ensure the business has enough cash to operate.

- Financial Reporting: Regular financial reports are essential for understanding how a business is doing. A vCFO prepares these reports to give insights into the company’s financial health.

- Risk Management: A virtual CFO identifies potential financial risks and helps businesses create strategies to minimize them.

- Strategic Advisory: Beyond just managing finances, a vCFO provides advice on how to grow the business and improve profitability.

- Compliance and Regulatory Guidance: They ensure that the business follows all financial laws and regulations, which can be complicated.

Benefits of a Virtual CFO Services

The benefits of virtual CFO services are many, and they can greatly help a business’s financial strategy. Here are some key advantages:

1. Cost-Effectiveness

One of the biggest benefits of hiring a virtual CFO is that it saves money. Traditional CFOs can be very expensive, often costing a lot of money each year. In contrast, virtual CFO pricing is usually much lower, allowing businesses to get expert financial help without spending too much.

2. Access to Expertise

Virtual CFOs have a lot of experience and knowledge. They have worked with many different businesses and can provide valuable insights that help companies make better decisions. This expertise is especially helpful for businesses that want to grow or face financial challenges.

3. Flexibility and Scalability

As businesses grow, their financial needs change. A virtual CFO can easily adjust their services to meet the changing needs of the business. This flexibility ensures that companies get the right support at every stage of their growth.

4. Enhanced Financial Strategy

With a virtual CFO, businesses can create and implement better financial strategies. By using data and best practices, a vCFO can help companies make informed decisions that lead to more profits and growth.

5. Improved Focus on Core Business Activities

When businesses outsource their financial management to a virtual CFO, they can focus on their main activities. This allows business owners and employees to spend more time on what they do best, which can lead to better overall performance.

6. Timely Financial Insights

A virtual CFO provides timely insights that help businesses stay ahead of potential problems. By monitoring key financial indicators, a vCFO can spot trends and recommend actions to address issues before they become serious.

7. Risk Mitigation

Managing risks is essential for any business. A virtual CFO helps identify financial risks and creates strategies to reduce them, ensuring that the business remains strong even in uncertain times.

Fractional CFO vs Virtual CFO

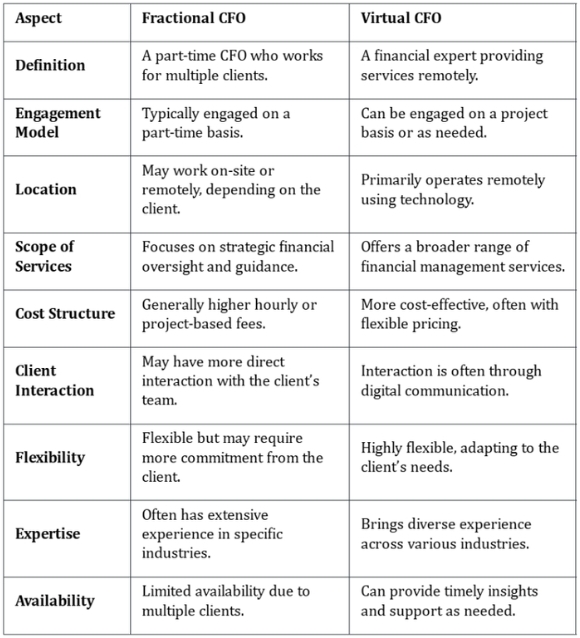

While people often use the terms fractional CFO and virtual CFO interchangeably, there are some differences. A fractional CFO usually works part-time for several clients, providing strategic guidance and oversight. On the other hand, a virtual CFO may offer a wider range of services, including operational support and financial management, often using technology to deliver these services remotely.

Both options give businesses access to high-level financial expertise without needing a full-time employee. However, the choice between a fractional CFO and a virtual CFO depends on what the business needs.

How to Choose Virtual CFO Service?

Choosing the right virtual CFO service is important for getting the most out of outsourcing financial management. Here are some key factors to consider:

1. Experience and Expertise

Look for a virtual CFO who has experience in your industry. Their knowledge will be helpful in dealing with the specific financial challenges your business may face.

2. Range of Services

Make sure the vCFO offers a variety of services that match your business needs. This can include financial planning, budgeting, cash flow management, and strategic advice.

3. Technology Proficiency

A virtual CFO should be skilled in using financial software and tools that help with remote work and data analysis. This ensures that you get timely insights and accurate financial reports.

4. Communication Skills

Good communication is key to a successful partnership. Choose a virtual CFO who can explain financial concepts clearly and provide actionable recommendations.

5. Client Testimonials and References

Look for client testimonials and references to understand the vCFO’s reputation and effectiveness. Positive feedback from other businesses can give you valuable insights into their capabilities.

6. Cost Structure

Understand how the virtual CFO charges for their services. Make sure it fits your budget and that there are no hidden fees.

7. Cultural Fit

Finally, consider how well the virtual CFO fits with your business culture. A good match in values and working styles can improve collaboration and lead to better results.

Conclusion

In conclusion, the benefits & role of virtual CFO services are significant for businesses looking to improve their financial strategies. By hiring a virtual CFO, companies can save money, gain valuable insights, and enhance their overall financial management. As businesses face more complex financial challenges, the role of a virtual CFO becomes increasingly important.

Whether you are a new startup trying to build a strong financial foundation or an established company looking to optimize your financial strategy, outsourcing global CFO services can provide the support you need to succeed. Embrace the future of financial management and unlock your business’s full potential with a virtual CFO.