Capital Gain Tax for NRIs: Rules, Rates, and Mutual Fund Implications

Capital Gains Tax for NRIs: Everything You Need to Know

Non-Resident Indians (NRIs) are required to comply with specific tax provisions on income generated from the sale of capital assets, such as property, shares, or mutual funds, in India. Navigating these rules effectively is essential to ensure compliance and optimize tax planning. This comprehensive guide will provide detailed insights into the applicable tax rates, available exemptions, and the process of filing income tax returns concerning capital gains tax for NRIs.

Overview of Capital Gains Tax for NRIs

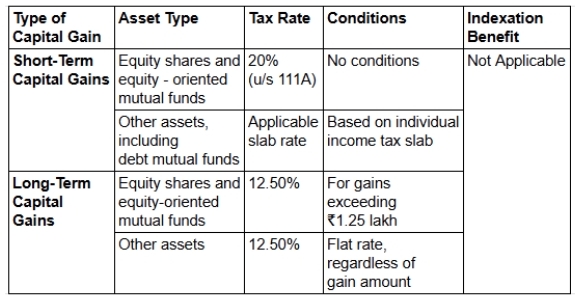

The capital gains tax for NRIs is imposed on profits made from selling capital assets in India. The nature of the gain—short-term or long-term—depends on how long the asset was held before the sale:

1. Short-Term Capital Gains (STCG)

Short-term capital gains arise when assets are sold within a shorter holding period:

- Equity shares or equity-oriented mutual funds: Held for less than 12 months.

- Other assets, including property: Held for less than 24 months.

2. Long-Term Capital Gains (LTCG)

Long-term capital gains occur when assets are held for longer than the specified periods mentioned above. Such gains are taxed at preferential rates, often with exemptions available under certain conditions.

Exemptions and Deductions Available to NRIs

NRIs can benefit from several exemptions under specific circumstances, particularly for long-term capital gains:

- Reinvestment in residential property: If the entire capital gain is reinvested in a new residential property within the specified timeframe, it becomes tax-exempt.

- Investment in bonds: NRIs can reduce their tax liability by investing in bonds issued by the National Highways Authority of India (NHAI) or the Rural Electrification Corporation (REC) within six months of the sale.

- Proceeds from non-residential property: Even if the property sold isn’t residential, reinvesting the proceeds in a residential property in India qualifies for tax exemptions.

Filing of Income Tax Returns

Although taxes on capital gains for NRIs are typically deducted at source (TDS), filing income tax returns is often necessary:

- Mandatory filing: If the total taxable income in India exceeds the basic exemption limit, filing is required.

- Claiming refunds: Filing a return allows NRIs to recover excess TDS if it surpasses their actual tax liability.

Do Non-Residents Pay Capital Gains Tax in India?

Yes, non-residents are liable to pay capital gains tax for NRIs on profits from the sale of assets in India. The tax applies even if they reside outside India. However, depending on the Double Taxation Avoidance Agreement (DTAA) between India and their country of residence, NRIs may benefit from reduced tax rates or exemptions.

Conclusion

For NRIs, compliance with capital gains tax is essential to avoid penalties and optimize tax efficiency. The taxation of capital gains varies based on the type of capital asset and the holding period. Investing in mutual funds or property requires careful consideration of tax rates, deductions, and exemptions. It is advisable to consult a tax expert to ensure proper compliance and effective tax planning.

Need help navigating capital gains tax for NRIs? Contact our tax experts today to simplify your tax planning and ensure compliance with the latest regulations.