USA Inheritance Tax: What You Need to Know

An Outline of USA Inheritance Tax: Rates, Exemptions, and Strategies

Introduction to Inheritance Tax

Inheritance tax is a state-tax imposed directly on the person who inherits property from a decedent. Unlike estate tax, which is paid by the deceased’s estate, inheritance tax is paid directly by the beneficiary based on the value of the inheritance. As of 2024, there is no federal inheritance tax, and only six states impose this tax. The applicability and rate of inheritance tax depend on factors such as the beneficiary’s relationship to the decedent, the value of the inherited assets, and the state where the decedent lived or owned property.

States That Impose Inheritance Tax

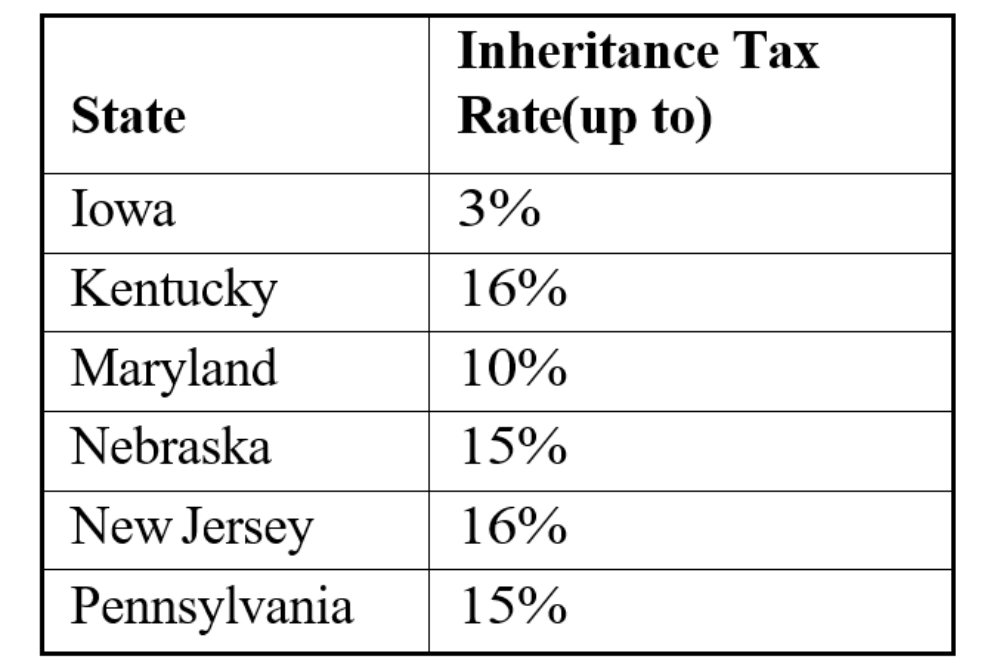

The table below provides an overview of the inheritance tax rates applicable in the six U.S. states that impose such taxes as of 2024. These rates reflect the percentage of tax, beneficiaries may owe on the assets they inherit, with some states imposing lower rates for close relatives and higher rates for distant heirs or unrelated individuals.

Note: Iowa has eliminated Inheritance tax effective from January 1, 2025.

Exemptions from Inheritance Tax

Spouses, including same-sex spouses, are automatically exempt from inheritance tax, regardless of the state where the property is located. In New Jersey, Kentucky, and Maryland, children and grandchildren are also exempt. However, in states like Pennsylvania and Nebraska, taxes may still apply to inheritances received by children, grandchildren, and other relatives. States also offer exemptions based on inheritance value; for instance, in New Jersey, siblings can inherit up to $25,000 tax-free, with amounts exceeding this limit t rates ranging from 11% to 16%.

Special Considerations for inheritance from non-residents

Inheritances from foreign persons are generally not taxed by the IRS, regardless of the recipient’s citizenship or residency status. However, some U.S. states may impose an inheritance tax, and residents, including non-citizens, must comply with their state tax laws.

A foreign inheritance or gift exceeding$100,000 from a non-resident alienor foreign estate must be reported to the IRS using Form 3520.While no taxes are due with this form, failure to file can lead to substantial penalties.

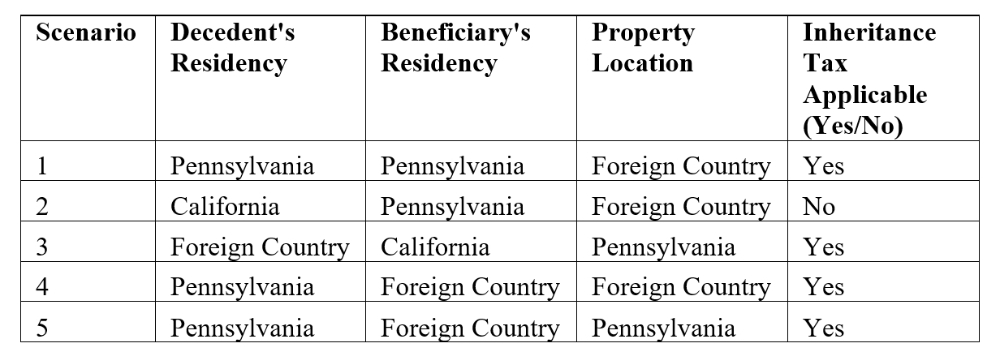

The inheritance tax on property received from a non-resident decedent is determined by the laws of the respective state. Most states apply their inheritance tax based on the decedent’s residency and whether the property is situated in that state. For instance ,in Pennsylvania, for a non-resident decedent, all real and tangible personal property located in Pennsylvania at the time of death is subject to inheritance tax, while intangible personal property is exempt. Beneficiary’s residency typically does not exempt the tax if the decedent was a Pennsylvania resident or if the property was located in Pennsylvania. Below table illustrates the applicability of inheritance tax in Pennsylvania in various scenarios:

In scenario 3, if in case the decedent was resident in the state of New Jersey (i.e. a state which levies inheritance tax) then New Jersey’s laws shall apply. However, when a nonresident of Pennsylvania owns real estate or tangible personal property in Pennsylvania, a REV-1737-AInheritance Tax Return must be filed.

Calculation and Filing Process for Inheritance Tax

The value on which the tax is imposed depends on state to state. Inheritance tax applies only to the portion of an inheritance exceeding the specified threshold and is typically assessed at progressive rates. For example, if the exemption is $100,000 and you inherit$150,000, tax is calculated on the excess amount of $50,000.At a 10% tax rate, the tax owed would be $5,000.

Filing process depends on respective state laws. For instance, in Pennsylvania,

‘Form REV-1500 must be filed by the executor or administrator of the estate or the person receiving the estate. Once the payment is completed, the form must be submitted to the Inheritance Tax Department. Inheritance Tax payments need to be directed to the Register of Wills for the county in which the decedent resided. These payments are due upon the date of death and become delinquent after nine months. If inheritance tax is paid within three months of the decedent’s death, a 5 percent discount is allowed.’

Strategies to Minimize Inheritance Tax Liability

While inheritance taxes often include exceptions and exemptions, particularly for spouses and children, individuals with substantial assets in states that impose inheritance taxes may consider strategies to reduce their heirs’ tax exposure.

One such strategy is purchasing a life insurance policy equivalent to the amount you intend to bequeath and naming the intended recipient as the policy’s beneficiary. Life insurance death benefits are generally exempt from inheritance taxes.

Another effective method is transferring assets into an irrevocable trust, which removes them from your taxable estate. By establishing the trust, you can control how and when the funds are distributed, ensuring they are no longer classified as part of your inheritance upon death.

Conclusion

Inheritance tax, while limited to a few U.S. states, remains an important consideration for individuals planning to transfer wealth to their heirs. Understanding the applicable tax laws, exemptions, and rates is crucial to minimize the financial burden on beneficiaries.

While spouses and close relatives often benefit from exemptions, other heirs may face significant tax liabilities. Strategies such as utilizing life insurance policies, establishing irrevocable trusts, and effective estate planning can help reduce or eliminate inheritance tax exposure.

Proactive planning is essential to safeguard your legacy. Consult with a qualified tax advisor or estate planning professional to explore your options and ensure your wealth is passed on efficiently and in line with legal requirements.